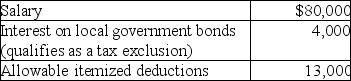

A single taxpayer provided the following information for 2017:  What is taxable income?

What is taxable income?

Definitions:

Information Content Effect

A market phenomenon where stock prices adjust in response to the news contained in a company announcement, suggesting the news has value for investors’ decisions.

Dividend Payout

The segment of a company's income that is given to shareholders in dividends.

Residual Dividend

A policy whereby a company pays dividends to its shareholders from the residual or leftover equity once all operational and capital expenditure needs are met.

Information Content

The value or significance of a piece of information, especially in terms of its utility in influencing decisions or behaviors in financial markets.

Q14: A taxpayer in the 25% marginal tax

Q20: If a corporation owns less than 20%

Q28: Carl filed his tax return,properly claiming the

Q30: Points paid to refinance a mortgage on

Q33: Rachel invests $5,000 in a money market

Q54: Randy and Sharon are married and have

Q82: Corporations may deduct 80% of dividends received

Q93: Which of the following factors is not

Q120: Courtney sells a cottage at the lake

Q139: Nonrefundable tax credits are allowed to reduce