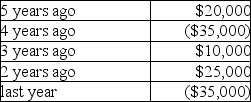

For this tax year,Madison Corporation had taxable income of $80,000 before using any of the net operating loss from the previous year.Madison has never elected to forgo the carryback of its losses since incorporation five years ago.Madison's books and records reflect the following income (loss) since its incorporation.  What amount of taxable income (loss) should Madison report on its current tax return?

What amount of taxable income (loss) should Madison report on its current tax return?

Definitions:

Work In Process

Goods that are in various stages of the production process but are not yet completed products.

Predetermined Overhead Rate

An estimated rate used to allocate manufacturing overhead to individual products or job orders based on a specific activity base.

Direct Labor-hours

The total number of work hours directly spent on manufacturing a product.

Materials Price Variance

The difference between the actual cost of materials purchased and the expected cost based on the standard price.

Q33: A qualifying child of the taxpayer must

Q37: The child and dependent care credit is

Q64: The term "gross income" means the total

Q72: Discuss the tax consequences of a complete

Q72: Doggie Rx Inc.is a new company developing

Q83: Chocolat Inc.is a U.S.chocolate manufacturer.Its domestic production

Q86: A Technical Advice Memorandum is usually<br>A)an internal

Q128: To help retain its talented workforce,Zapper Corporation

Q129: Mr.& Mrs.Tsayong are both over 66 years

Q134: Kuda exchanges property with a FMV of