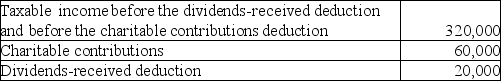

Louisiana Land Corporation reported the following results for the current year:  What is the amount of the taxable income for the current year?

What is the amount of the taxable income for the current year?

Definitions:

Competencies

The skills, knowledge, and abilities that enable a person to perform tasks effectively.

Necessary Skills

Essential abilities required to effectively perform a task or job, often within a specific context like therapeutic practice.

Client Factors

Characteristics of a client that may influence the counseling process, including history, personality, and current circumstances.

Extratherapeutic Factors

These are elements outside of therapy itself that can influence a client's healing process, such as personal strengths, social support, and environmental factors.

Q8: Tom and Anita are married,file a joint

Q12: A married taxpayer may file as head

Q22: Charlie is claimed as a dependent on

Q23: Individuals Rhett and Scarlet form Lady Corporation.Rhett

Q29: One of the characteristics of the Exempt

Q37: Regulations issued prior to the latest tax

Q72: If an individual with a marginal tax

Q82: Clark and Lois formed an equal partnership

Q111: All of the following business forms offer

Q148: Tester Corporation acquired all of the stock