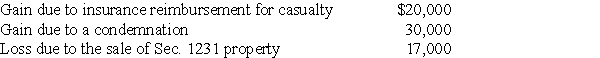

The following are gains and losses recognized in 2017 on Ann's business assets that were held for more than one year.The assets qualify as Sec.1231 property.

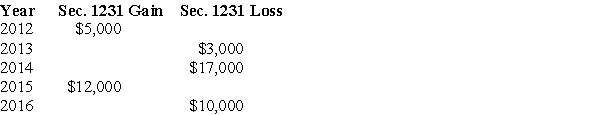

A summary of Ann's net Sec.1231 gains and losses for the previous five-year period is as follows:

A summary of Ann's net Sec.1231 gains and losses for the previous five-year period is as follows:

Describe the specific tax treatment of each of the current year transactions.

Describe the specific tax treatment of each of the current year transactions.

Definitions:

Monopsonist

A market condition in which a single buyer substantially controls the market as the major purchaser of goods and services.

Profit-Maximizing Quantities

The level of output at which a firm maximizes its profit, determined by the point where marginal cost equals marginal revenue.

Occupational Licensing

The laws of state or local governments that require that a worker satisfy certain specified requirements and obtain a license from a licensing board before engaging in a particular occupation.

Exclusive Unionism

The policy, pursued by many craft unions, in which a union first gets employers to agree to hire only union workers and then excludes many workers from joining the union so as to restrict the supply of labor and drive up wages. Compare with inclusive unionism. The policies typically employed by a craft union.

Q3: Which of the following documents is issued

Q8: Tom and Anita are married,file a joint

Q18: Sarah owned land with a FMV of

Q33: Residential rental property is defined as property

Q35: Sec.1245 recapture applies to all the following

Q41: Daniella exchanges business equipment with a $100,000

Q75: Lucy,a noncorporate taxpayer,experienced the following Sec.1231 gains

Q82: Corporations may deduct 80% of dividends received

Q101: An accrual of a reserve for bad

Q124: A taxpayer must use the same accounting