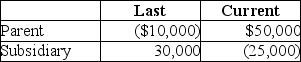

Parent and Subsidiary Corporations form an affiliated group.Last year,the initial year of operation,Parent and Subsidiary filed separate returns.This year,the group files a consolidated tax return.The results for last year and the current year are: Taxable Income How much of Subsidiary's loss can be carried back to last year?

How much of Subsidiary's loss can be carried back to last year?

Definitions:

Instrumental Role

In sociology, a role focused on achieving goals, often associated with providing for the family's material needs.

Child Rearing

The process of supporting and promoting the physical, emotional, social, and intellectual development of a child from infancy to adulthood.

Extended Family

A family unit that extends beyond the nuclear family and includes grandparents, aunts, uncles, and other relatives.

Generations

Groups of people born and living during the same period, typically considered to be about thirty years, influencing society's dynamics through their collective experiences.

Q4: Capital improvements to real property must be

Q9: Mariano owns all of Alpha Corporation,which owns

Q17: Meg and Abby are equal partners in

Q21: Sales having a tax-avoidance purpose - Loss

Q59: Gee Corporation purchased land from an unrelated

Q66: Identify which of the following statements is

Q73: A corporation is required to file Form

Q78: What are the advantages and disadvantages of

Q80: Stone Corporation redeems 1,000 share of its

Q107: Jack has a basis of $36,000 in