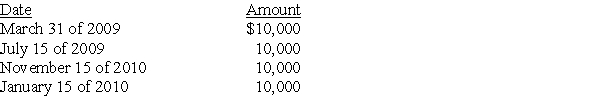

Jack has a basis of $36,000 in his 1,000 shares of Acorn Corporation stock (a capital asset).The stock was acquired three years ago.He receives the following distributions as part of a plan of liquidation of Acorn Corporation:

What are the amount and character of the gain or loss that Jack will recognize during 2009? During 2010?

What are the amount and character of the gain or loss that Jack will recognize during 2009? During 2010?

Definitions:

Board of Directors

A group of elected or appointed members who jointly oversee the activities of a company or organization.

Voting Trust

A type of shareholder voting arrangement by which shareholders transfer their voting rights to a voting trustee.

Model Business Corporation Act

A template law provided to guide states in the drafting of their own corporate statutes, aimed at promoting uniformity and clarity in corporate governance and activity.

Majority Shareholders

Individuals or entities that own more than half of the shares in a corporation, giving them significant control over the company's decisions.

Q12: Identify which of the following statements is

Q15: Which of the following serves as the

Q25: Identify which of the following statements is

Q28: Hydrangia Corporation reports the following results for

Q31: Identify which of the following statements is

Q34: Bluebird Corporation owns and operates busses and

Q46: What is the carryback and carryforward rule

Q71: In a nontaxable reorganization,the holding period for

Q78: What are the advantages and disadvantages of

Q94: Money Corporation has the following income and