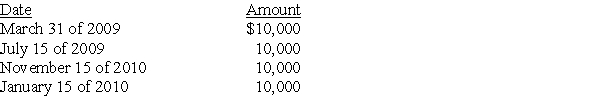

Jack has a basis of $36,000 in his 1,000 shares of Acorn Corporation stock (a capital asset).The stock was acquired three years ago.He receives the following distributions as part of a plan of liquidation of Acorn Corporation:

What are the amount and character of the gain or loss that Jack will recognize during 2009? During 2010?

What are the amount and character of the gain or loss that Jack will recognize during 2009? During 2010?

Definitions:

Encoding And Decoding

The processes of transforming information into a form that can be stored (encoding) and later retrieved (decoding) from memory.

Communication Patterns

Refers to the habitual ways in which individuals and groups interact and exchange information.

Maritally Satisfied

A term used to describe individuals or couples who experience contentment and fulfillment in their marital relationship, often assessed through various psychological measures.

Discourse Analysis

A set of methods used to analyse text – in particular, naturally occurring language – in order to understand its meaning and significance.

Q5: This year,John,Meg,and Karen form Frost Corporation.John contributes

Q13: Yolanda transfers land,a capital asset,having a $70,000

Q18: Hope Corporation was liquidated four years ago.Teresa

Q27: Identify which of the following statements is

Q29: In a complete liquidation,a liability assumed by

Q62: There are no questions for this section.

Q64: Flow-through entities do not have to file

Q66: Identify which of the following statements is

Q102: Which of the following entities is subject

Q112: Albert contributes a Sec.1231 asset to a