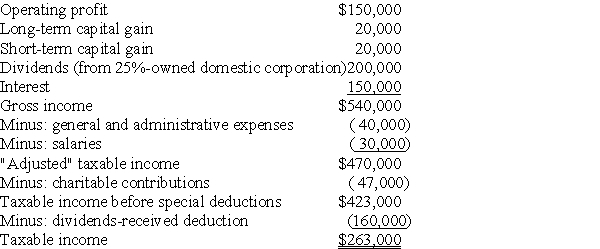

Mullins Corporation is classified as a PHC for the current year,reporting $263,000 of taxable income on its federal income tax return:

Actual charitable contributions made by Mullins Corporation were $75,000.What are the federal income tax due and the personal holding company (PHC)tax liability? Discuss the methods (if any)by which payment of the PHC tax can be avoided.

Actual charitable contributions made by Mullins Corporation were $75,000.What are the federal income tax due and the personal holding company (PHC)tax liability? Discuss the methods (if any)by which payment of the PHC tax can be avoided.

Definitions:

Q14: Grant Corporation transfers highly appreciated stock to

Q15: Identify which of the following statements is

Q24: A foreign corporation is owned by five

Q39: What is the IRS's position regarding whether

Q71: When computing the accumulated earnings tax,the dividends-paid

Q84: Generally,a corporation recognizes a gain,but not a

Q87: Blair and Cannon Corporations are the two

Q98: The Sec.338 deemed sale rules require that

Q105: If an individual transfers an ongoing business

Q114: The XYZ Partnership is held by ten