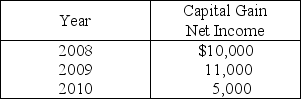

Evans Corporation has a $15,000 net capital loss in 2011.The corporation reported the following capital gain net income during the past three years.Identify which of the following statements is true.

Definitions:

Q2: Bruce receives 20 stock rights in a

Q18: Acquiring Corporation acquires at the close of

Q26: A corporation distributes land and the related

Q26: Boxcar Corporation and Sidecar Corporation,an affiliated group,reports

Q29: Family Corporation,a corporation controlled by Buddy's family,redeems

Q35: Identify which of the following statements is

Q81: Bart,a 50% owner of Atlas Corporation's common

Q87: Blair and Cannon Corporations are the two

Q87: A calendar-year individual taxpayer files last year's

Q89: Property received in a corporate liquidation by