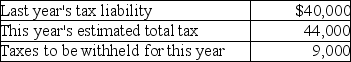

Your client wants to avoid any penalty for underpayment of estimated taxes by making timely deposits.Determine the amount of the minimum quarterly estimated tax payments required to avoid the penalty.Assume your client's adjusted gross income last year was $140,000.

Definitions:

Right Intention

The ethical principle that actions should be guided by good or morally correct purposes.

Properly Authorized

Officially or formally approved or sanctioned, according to the relevant laws or standards.

Control Orders

Legal measures imposed by governments to restrict the freedom of individuals for security reasons, often without a prior trial.

Terrorist Attacks

Acts of violence or intimidation, usually motivated by political, religious, or ideological beliefs, aimed at creating fear, disrupting societies, and achieving specific goals.

Q8: The following expenses are incurred by Salter

Q32: What is the IRS guideline for determining

Q42: For the foreign credit limitation calculation,income derived

Q58: For innocent spouse relief to apply,five conditions

Q61: Connie has some acreage that is valued

Q66: An executor can value each asset in

Q81: Identify which of the following statements is

Q82: April Corporation's Subchapter S election was voluntarily

Q83: Which of the following statements regarding inversions

Q95: Identify which of the following statements is