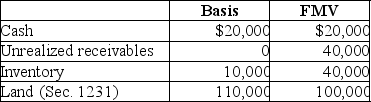

Steve sells his 20% partnership interest having a $28,000 basis to Nancy for $40,000 cash.At the time of the sale,the partnership has no liabilities and its assets are as follows:  The receivables and inventory are Sec.751 assets.There is no agreement concerning the allocation of the sales price.Steve must recognize

The receivables and inventory are Sec.751 assets.There is no agreement concerning the allocation of the sales price.Steve must recognize

Definitions:

Pain

An unpleasant sensory and emotional experience associated with actual or potential tissue damage, or described in terms of such damage.

Recovery

The process of returning to a normal state of health, mind, or strength after experiencing damage or illness.

Exercise

Physical activities undertaken to maintain or enhance health and fitness, including aerobic, strength, flexibility, and balance exercises.

Stress

The body's reaction to any change that requires an adjustment or response, which can be physical, mental, or emotional.

Q3: What are some strategies for enhancing technology-mediated

Q9: When it comes to learning,negotiators often fail

Q11: The Boulwarism strategy,named after a former CEO,often

Q25: A trust has net accounting income of

Q28: Which of the following is not a

Q54: In November 1976,Grant uses $30,000 of the

Q55: In all situations,tax considerations are of primary

Q85: The changing of a life insurance policy

Q86: Distributable net income (DNI)does not include capital

Q88: Which tax service is usually deemed to