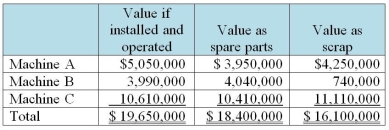

Celtic Company bought three used machines located in Toronto for $20,000,000.The arrangement with the seller is to move all the equipment to Celtic's factory in Edmonton.It is understood that some of the equipment will be sold as scrap or disassembled and used as spare parts.A careful inventory of all the equipment is shown below.Celtic's plans are to maximize the value of each item by using it in its most beneficial manner.

Required:

Allocate the purchase price among the assets acquired.

Definitions:

Steroids

Organic compounds with four rings arranged in a specific molecular configuration, used in medicine and for performance enhancement.

Lurking Variables

Hidden or unobserved variables that can influence the outcome of an experiment or study without being explicitly considered.

Random Assignment

A method used in experiments to assign participants to different groups in a way that each has an equal chance of being placed in any group, aiming to eliminate bias and ensure that groups are comparable.

Confounding Variables

Factors other than the independent variable that might affect the outcome of an experiment or study, potentially leading to erroneous conclusions.

Q6: Pauline Company estimates the allowance for doubtful

Q33: Grape Company (GC)had been renting an office

Q41: Which of the following statements about the

Q48: Mathew Corp exchanged similar assets with Simone

Q51: Explain why the absorption costing method is

Q102: Explain why earnings manipulation of property,plant and

Q108: Based on the following information for calendar

Q108: What are "costs of disposal"?<br>A)The incremental costs

Q108: What fraction of radioactive atoms remains in

Q114: Coffee-Bean Company built two similar buildings.Each building