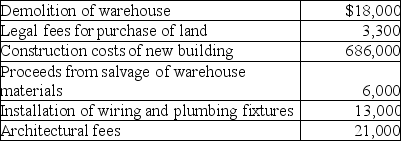

Grape Company (GC)had been renting an office building for several years.On January 1,2019,GC decided to have a new office building constructed.On that date,it acquired land with an abandoned warehouse on it for $350,000.Other costs included the following:

Required:

a.Calculate at what amount GC should record the (i)land and (ii)building.

b.Assume that the building was completed and occupied on December 31,2019.It has an estimated useful life of 40 years,with residual value of $140,000.Calculate depreciation for 2020 using (i)the straight-line method and (ii)the double declining balance method.

c.Assume that management decided to use straight-line depreciation for the building.By 2023 GC had

grown considerably and needed to relocate for more space;it sold the land and building to Macaw Company on July 1,2023 for $1,350,000.Assume depreciation expense has already been recorded for the first six months of the year (Jan.1,2023 to June 30,2023).Prepare all journal entries required relating to the land and building accounts on July 1,2023.

Definitions:

Experience And Is

Refers to the knowledge or skill acquired through involvement in or exposure to events.

Head Start

A program in the United States that provides comprehensive early childhood education, health, nutrition, and parent involvement services to low-income children and their families.

Cognitive Performance

Refers to the capacity to use mental processes to solve problems or to learn new concepts.

Difficult Temperament

A temperament characterized by irregularity in biological rhythms, slow adaptation to change, and a tendency for intense negative reactions.

Q1: How many structural isomers are there of

Q16: The secondary structure of a protein is

Q21: When a <sup>87</sup>Br nucleus emits a beta

Q22: Explain what financial assets are,how they differ

Q28: What amount will be included in "cash

Q58: What journal entry is required when inventory

Q59: Based on the following information,what is the

Q69: WestCoast Co.started a contract in June 2017

Q81: Kryan Corp.mines and produces aluminum.During 2018,the company

Q154: Assume that ending inventory in fiscal 2016