WestCoast Co.started a contract in June 2017 to build a bridge at a fixed price of $14 million.The bridge was to be completed by October 2019.Total cumulative costs incurred by the end of December 2017 and 2018 were $2 million and $6 million,respectively.WestCoast Co.is unable to estimate the total costs of the project prior to completion.Final costs at the end of the project totaled $11 million.

Required:

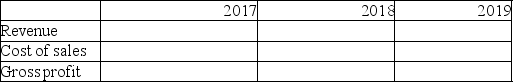

Determine the amount of revenue,cost of sales,and gross profit WestCoast Co.would report in 2017,2018,and 2019.

Definitions:

FOB Shipping Point

A term in shipping agreements where the buyer is responsible for the goods and their transportation cost as soon as they leave the seller's premises.

Ownership of Merchandise

The legal right or title to goods and inventory held by a business for sale.

Multiple-Step Income Statement

A detailed financial statement that separates operating revenues and expenses from non-operating ones, providing insights into a company's financial activities.

Gross Profit

The difference between sales revenue and the cost of goods sold before deducting operating expenses.

Q2: Which statement best explains "moral hazard"?<br>A)The term

Q44: The following entry was recorded by Hollow

Q47: The residual approach which computes the stand-alone

Q52: Assume that a purchase invoice for $1,000

Q67: On January 25,2016,Mulroney Ltd.purchased 100 common shares

Q68: Your weight is always _.<br>A)greater than your

Q93: Mandel Corp.repaid a bank loan for $980,000.What

Q117: Philips has a 50% joint operation interest

Q127: Explain how items of inventory should be

Q146: Consider the following inventory information for last