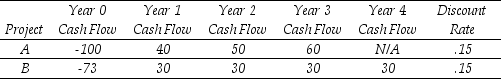

Use the table for the question(s) below.

Consider the following two projects with cash flows in $:

-The profitability index for project B is closest to:

Definitions:

Social Involvement

The degree to which an individual participates in a broad range of social activities and engages with their community.

Happiness

A state of well-being and contentment characterized by positive emotions and fulfillment.

Children

Young human beings who are not yet adults, characterized by rapid physical growth, cognitive development, and emotional maturation.

Young Adults

Young adults are individuals who are in a transitional stage of physical and psychological development that generally occurs during the period from the late teens through the twenties.

Q6: Insurance that compensates for the loss or

Q10: Which of the following is a role

Q18: The introduction of DNA into a bacterial

Q39: What is the NPV of an investment

Q41: Assuming that your capital is constrained,what is

Q43: If the current inflation rate is 4%

Q51: You have an investment opportunity that will

Q59: Suppose you plan to hold Von Bora

Q72: You are considering using the incremental IRR

Q78: Which of the following statements is FALSE?<br>A)The