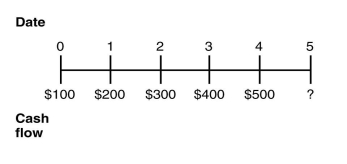

Consider the following timeline detailing a stream of cash flows:

If the current market rate of interest is 6%,then the future value of this stream of cash flows is closest to:

Definitions:

Macro Processes

Refers to the overarching, large-scale operations or functions within a system or organization that influence its overall performance.

Supply Chain

A supply chain encompasses the sequence of processes involved in the production and distribution of a commodity, from the procurement of raw materials to the delivery of the finished product to the end consumer.

Supply Chain Flows

The movement of goods, information, and finances as they pass through a set of entities from supplier to manufacturer to wholesaler to retailer to consumer.

Importance

The state or fact of being of great significance, value, or consequence.

Q1: Which of the following statements is FALSE?<br>A)Firms

Q13: The profitability index for project A is

Q15: If interest rates are currently 5%,but fall

Q20: Suppose that the ETF is trading for

Q30: The Rufus Corporation has 125 million shares

Q35: The level of incremental sales associated with

Q51: Which of the following statements regarding mergers

Q54: The amount that the price of bond

Q73: If the discount rate is 15%,the alternative

Q84: The NPV of manufacturing the armatures in