Use the following information to answer the question(s) below.

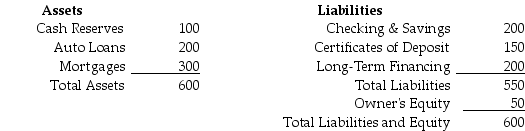

You are a risk manager for Security First Trust Savings and Loan (SFTSL) .SFTSL's balance sheet is as follows (in millions of dollars) :  The duration of the auto loans is three years and the duration of the mortgages is eight years.Both cash reserves and checking and savings have zero duration.The CDs have a duration of two years and the long-term financing has a ten-year duration.

The duration of the auto loans is three years and the duration of the mortgages is eight years.Both cash reserves and checking and savings have zero duration.The CDs have a duration of two years and the long-term financing has a ten-year duration.

-If interest rates are currently 5%,but fall to 4%,your estimate of the approximate change in SFTSL equity is closest to:

Definitions:

American Southwest

A geographical region in the United States characterized by arid deserts, unique cultures, and significant historical landmarks.

1920s

A decade characterized by dramatic social and political change, economic prosperity in the United States, and the rise of jazz music and the flapper subculture.

Emergence

The process of coming into being or of becoming prominent or important, often used in the context of ideas, trends, or phenomena.

Ku Klux Klan

A white supremacist hate group in the United States, originally founded in the aftermath of the Civil War, known for promoting racism, anti-Semitism, and xenophobia.

Q1: Luther Industries bills its accounts on terms

Q2: What is the relationship between a bond's

Q3: Which of the following firms is likely

Q12: Which of the following statements is FALSE?<br>A)As

Q13: Consider two firms,Zoe Corporation and Marley Company.Both

Q15: Using the covered interest parity condition,the calculated

Q21: Which of the following statements is FALSE?<br>A)The

Q39: In January 2010,the U.S.Treasury issued a $1000

Q43: If the current inflation rate is 4%

Q46: The market value of Wyatt Oil after