Use the following information to answer the question(s) below.

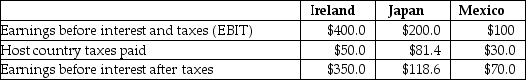

Incorporated Tool,a U.S.firm,is considering its international tax situation.The corporate tax rate in the U.S.is currently 39%.Incorporated Tool has major operations in Ireland,where the tax rate is 12.5%,Japan where the tax rate is 40.7%,and Mexico,where the tax rate is 30.0%.Incorporated Tool's profits,which are fully and immediately repatriated,and foreign taxes paid for the current year are as follows:

-Assuming that the Japanese and Mexican subsidiaries did not exist,the U.S.tax liability on the Irish subsidiary would be closest to:

Definitions:

Employment Testing

The practice of administering tests to job applicants or employees to assess their suitability for specific roles or tasks.

Job Skills Test

An examination designed to measure a person's abilities and competencies in a specific role or profession.

Polygraph Testing

A lie detector test that measures physiological responses to questions to determine the truthfulness of answers.

Job Sample Simulation

A testing method used in employee selection that involves giving the candidate a task or set of tasks to perform that are representative of the actual job.

Q13: Which of the following statements is FALSE?<br>A)The

Q14: Suppose the current exchange rate is $1.42/€,the

Q16: An American Depository Receipt (ADR)is a security

Q28: The internal rate of return (IRR)for project

Q32: Which of the following statements is FALSE?<br>A)If

Q36: In December 2005,the spot exchange rate for

Q36: If the current inflation rate is 5%,then

Q47: Consider a bond that pays annually an

Q49: The share of any positive return generated

Q62: The yield to maturity for the three