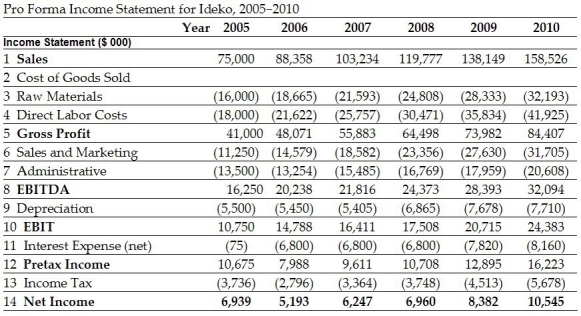

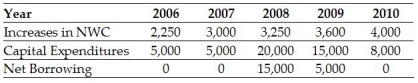

Use the following information to answer the question(s) below:

-The after tax interest expense in 2008 is closest to:

Definitions:

Replacement Period

The specified time frame within which property must be replaced to defer recognition of gains for tax purposes.

Recognized Gain

The portion of a capital gain that must be reported as income for tax purposes.

Excluded Gain

Profit from the sale of an asset that can be exempt from taxes, often related to home sales under specific Internal Revenue Code sections.

Recognized Gain

The portion of a capital gain on which taxes must be paid, typically realized when an asset is sold for more than its purchase price.

Q1: The cash flows of a collateralized debt

Q10: Assuming that this project will provide Rearden

Q20: The interest tax shield provided by Omicron's

Q21: What will the offer price of these

Q23: Equity in a firm with no debt

Q26: Assume you want to buy one option

Q40: Off-balance sheet transactions are required to be

Q45: The holder of a put option has:<br>A)the

Q83: The weighted average cost of capital for

Q108: Suppose that MI has zero-coupon debt with