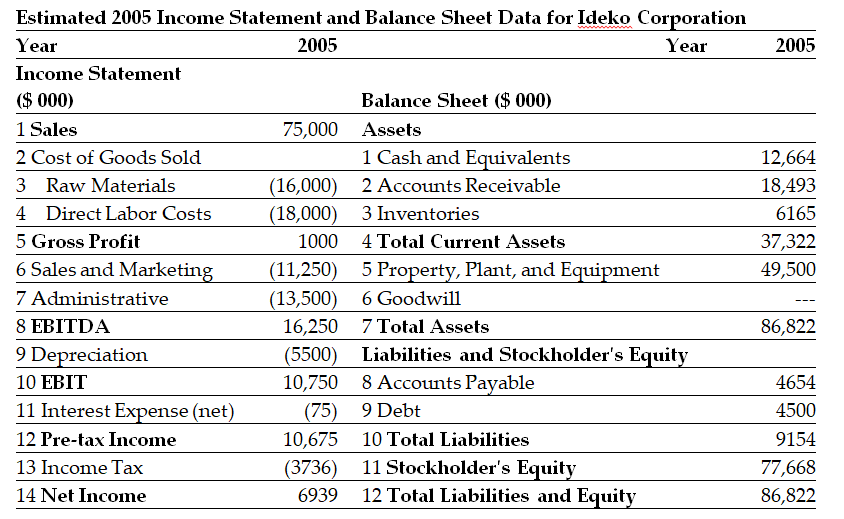

Use the tables for the question(s) below.

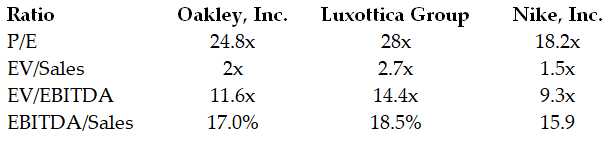

The following are financial ratios for three comparable companies:

-Based upon the average EV/EBITDA ratio of the comparable firms,if Ideko holds $6.5 million of cash in excess of its working capital needs,then Ideko's target market value of equity is closest to:

Definitions:

Loan Repayment

The process of paying back borrowed money, typically in installments over a set term.

T-Bill

Short-term government debt security with a maturity of less than one year.

Simple Interest

A method of calculating interest where it is applied only to the principal amount, not on the accumulated interest.

Profit

The financial gain obtained when revenue from business activities exceeds the expenses, costs, and taxes involved in operating.

Q3: Luther Corporation's stock price is $39 per

Q8: According to MM Proposition 1,the stock price

Q25: Net of capital gains taxes,the amount the

Q33: Which of the following statements is FALSE?<br>A)Leverage

Q35: Which of the following statements is FALSE?<br>A)If

Q37: Which of the following statements is FALSE?<br>A)To

Q75: Consider the following equation for the Project

Q78: Luther Corporation's stock price is $39 per

Q83: For the year ending December 31,2009 Luther's

Q87: Which of the following statements is FALSE?<br>A)The