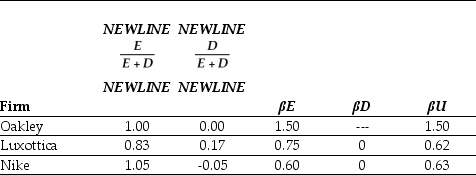

Use the table for the question(s) below.

Capital Structure and Unlevered Beta Estimates for Comparable Firms

-If the risk-free rate of interest is 6% and the market risk premium has historically averaged 5%,then the cost of capital for Luxottica is closest to:

Definitions:

American Tobacco

The American Tobacco Company was a major American tobacco company founded in 1890 by J.B. Duke, which played a significant role in the development of the tobacco industry in the United States.

Labor Unions

Labor unions are organized groups of workers that aim to protect and advance their members' interests through collective bargaining with employers.

Antitrust Enforcement

The regulation and legal processes initiated by governments to prevent or reduce anti-competitive practices and promote fair competition among firms.

Horizontal Merger

A merger between firms that are in direct competition with each other, operating in the same industry and often in the same markets.

Q2: Which of the following statements is FALSE?<br>A)Because

Q4: Which of the following statements is FALSE?<br>A)Absent

Q12: Assuming that Kinston has the ability to

Q12: The effective dividend tax rate for a

Q13: Which of the following is NOT a

Q17: A(n)_ invests in the equity of existing

Q26: Assuming that Kinston does not have the

Q31: Assuming that Ideko has a EBITDA multiple

Q38: The equivalent annual benefit of project A

Q76: Louie's Truck Repair has assets with a