Use the information for the question(s) below.

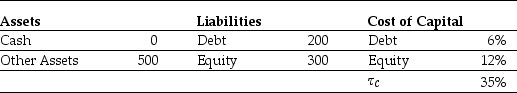

Omicron Industries' Market Value Balance Sheet ($ Millions)

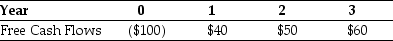

and Cost of Capital  Omicron Industries New Project Free Cash Flows

Omicron Industries New Project Free Cash Flows  Assume that this new project is of average risk for Omicron and that the firm wants to hold constant its debt to equity ratio.

Assume that this new project is of average risk for Omicron and that the firm wants to hold constant its debt to equity ratio.

-Omicron's weighted average cost of capital is closest to:

Definitions:

Future Value

The value of an asset or amount of money at a specified future date, taking into account variables such as interest rates or returns on investment.

Interest

The fee associated with the opportunity to borrow capital, often specified in terms of an annual percentage rate.

Future Value

The predicted amount of money that a current investment will grow to at a certain future date, based on an assumed rate of growth or interest rate.

Interest

Interest is the charge for the privilege of borrowing money, typically expressed as an annual percentage rate.

Q6: Suppose that you borrow $30,000 in financing

Q8: The free cash flow to the firm

Q19: If Firm A and Firm B are

Q23: Assume it is now January of 2007

Q27: Assuming that this project will provide Rearden

Q33: Which of the following statements is FALSE?<br>A)With

Q34: The average number of inventory days outstanding

Q49: The amount of the increase in net

Q73: Prior to any borrowing and share repurchase,the

Q73: Which of the following statements is FALSE?<br>A)As