Use the information for the question(s)below.

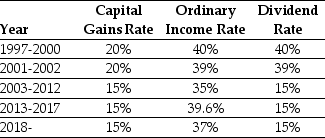

Consider the following tax rates:  *The current tax rates are set to expire after 2025 unless Congress extends them.The tax rates shown are for financial assets held for one year.For assets held less than one year,capital gains are taxed at the ordinary income tax rate (currently 37% for the highest bracket);the same is true for dividends if the assets are held for less than 61 days.

*The current tax rates are set to expire after 2025 unless Congress extends them.The tax rates shown are for financial assets held for one year.For assets held less than one year,capital gains are taxed at the ordinary income tax rate (currently 37% for the highest bracket);the same is true for dividends if the assets are held for less than 61 days.

-Using the available tax information for 2002,calculate the effective dividend tax rate for a:

(1)one-year individual investor

(2)buy and hold individual investor

(3)pension fund

Definitions:

Substitution Effect

The change in consumption patterns due to a change in the relative prices of goods, leading consumers to replace more expensive items with less costly alternatives.

Higher Wage

Refers to an increase in the amount of money that an employee receives for performing one hour or another standard unit of work.

Leisure Time

Free time that an individual can spend away from work, chores, and other compulsory activities, often used for relaxation or hobbies.

Labor Supply Curve

A visual diagram illustrating how the quantity of labor supplied is influenced by changes in the wage rate.

Q20: Using the FFC four factor model and

Q25: The unlevered cost of capital for Antelope

Q25: Following the borrowing of $12 million and

Q42: Which of the following statements is FALSE?<br>A)A

Q52: Wyatt Oil has a net profit margin

Q57: If Flagstaff maintains a debt to equity

Q63: Which of the following statements is FALSE?<br>A)In

Q82: Which of the following statements is FALSE?<br>A)If

Q86: Assume that Omicron uses the entire $50

Q87: Which of the following statements is FALSE?<br>A)The