Use the information for the question(s)below.

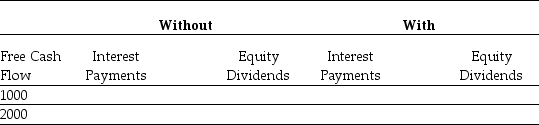

Consider two firms: firm Without has no debt,and firm With has debt of $10,000 on which it pays interest of 5% per year.Both companies have identical projects that generate free cash flows of $1000 or $2000 each year.Suppose that there are no taxes,and after paying any interest on debt,both companies use all remaining cash free cash flows to pay dividends each year.

-Fill in the table below showing the payments debt and equity holders of each firm will receive given each of the two possible levels of free cash flows:

Definitions:

Matching Principle

An accounting principle that expenses should be recorded in the same period as the revenues they helped to generate, to provide a more accurate picture of financial performance.

Deferrals

Accounting transactions that involve recognition of revenues or expenses in a period different from when they are actually received or paid, to match revenues with expenses in the appropriate period.

Accruals

Accounting adjustments for revenues that have been earned or expenses that have been incurred but are not yet recorded in the accounts.

Deferred Revenue

Money received by a company for goods or services not yet delivered or performed, recorded as a liability until the transaction is completed.

Q2: If you take the job with Wyatt

Q6: Which of the following statements is FALSE?<br>A)The

Q12: Equity in a firm with debt is

Q25: Following the borrowing of $12 million and

Q38: Suppose that you want to use the

Q58: Which of the following statements is FALSE?<br>A)Beta

Q59: If investors have relative wealth concerns,they care

Q60: Which of the following statements is FALSE?<br>A)The

Q94: Will adding the precious metals fund improve

Q99: What is a market value balance sheet