Use the information for the question(s)below.

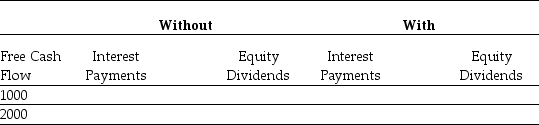

Consider two firms: firm Without has no debt,and firm With has debt of $10,000 on which it pays interest of 5% per year.Both companies have identical projects that generate free cash flows of $1000 or $2000 each year.Suppose that there are no taxes,and after paying any interest on debt,both companies use all remaining cash free cash flows to pay dividends each year.

-Fill in the table below showing the payments debt and equity holders of each firm will receive given each of the two possible levels of free cash flows:

Definitions:

Par Value

The face value of a bond or stock as stated by the issuing company, which does not necessarily coincide with its market value.

Expiration Date

In finance, this term often refers to the date on which a derivative contract, such as an option or futures contract, becomes void and ceases to trade.

Option Contract

A financial derivative contract that grants the buyer the right, but not the obligation, to buy or sell an asset at a specified price on or before a certain date.

Exercise Price

The price at which the holder of an option can buy or sell the underlying security.

Q4: Assuming that Ideko has a EBITDA multiple

Q12: Equity in a firm with debt is

Q15: The total debt overhang associated with accepting

Q34: Which of the following equations is INCORRECT?<br>A)V<sub>L</sub>

Q37: Which of the following statements is FALSE?<br>A)The

Q48: Assuming that Ideko has a EBITDA multiple

Q50: Which of the following statements is FALSE?<br>A)Rather

Q63: Which of the following statements is FALSE?<br>A)For

Q87: Monsters' beta with the market is closest

Q94: Two separate firms are considering investing in