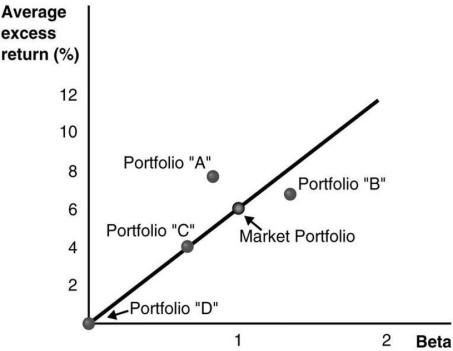

Use the figure for the question(s) below.Consider the following graph of the security market line:

-Which of the following statements regarding portfolio "A" is/are correct? 1.Portfolio "A" has a positive alpha.

2.Portfolio "A" is overpriced.

3.Portfolio "A" is less risky than the market portfolio.

4.Portfolio "A" should not exist if the market portfolio is efficient.

Definitions:

Pooling Equilibrium

A situation in a market with incomplete information where different types of economic agents are treated indistinguishably due to a lack of distinguishing information.

Agents

Individuals or entities that act on behalf of others in economic transactions or negotiations, making decisions and taking actions.

Total Value

The complete worth or sum of all financial, labor, or material resources in a given context.

Total Value

The overall value of an asset, investment, or portfolio, taking into account all relevant financial factors.

Q9: Which development phase has the task of

Q12: The overall asset beta for Wyatt Oil

Q26: The value of Shepard Industries with leverage

Q39: Assuming Luther issues a 5:2 stock split,then

Q45: The price per share of Iota if

Q48: Suppose that you want to use the

Q78: Assume that investors in Google pay a

Q94: Which of the following statements is FALSE?<br>A)The

Q134: The variance on a portfolio that is

Q157: Corrective maintenance is conducted to improve the