Use the following information to answer the question(s) below.

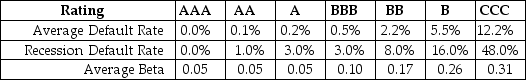

Consider the following information regarding corporate bonds:

-Nielson Motors plans to issue 10-year bonds that it believes will have an BBB rating.Suppose AAA bonds with the same maturity have a 3.5% yield.Assume that the market risk premium is 5% and the expected loss rate in the event of default on the bonds is 60%.The yield that these bonds will have to pay during a recession is closest to:

Definitions:

Macro Factors

Macro Factors are large-scale, national, or international elements or forces that affect the economy or the financial markets, such as inflation, unemployment, and fiscal policy.

Risk Premium

The additional return expected by an investor for taking on a higher risk compared to a risk-free investment.

Multifactor APT

A finance model that describes asset prices by taking into account several risk factors, expanding on the Arbitrage Pricing Theory by including multiple variables.

Q17: What type of company trades on an

Q39: The cost of capital for a project

Q51: Which of the following statements is FALSE?<br>A)The

Q68: Which of the following investments offered the

Q76: Assume that investors in Google pay a

Q77: Suppose that d'Anconia Copper retained the $200

Q80: The risk-free rate is closest to:<br>A)0%<br>B)4%<br>C)8%<br>D)16%

Q89: Which of the following statements is FALSE?<br>A)When

Q101: Determination of user requirements in the analysis

Q173: One task of the _ phase is