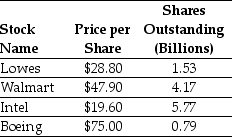

Use the table for the question(s) below.

Consider the following stock price and shares outstanding data:

-Assume that you have $100,000 to invest and you are interested in creating a value-weighted portfolio of these four stocks.The percentage of the shares outstanding of Boeing that you would hold in your portfolio is closest to:

Definitions:

Petition For Divorce

A legal document filed by an individual seeking to formally end their marriage in court.

Marital Property

All property acquired during the course of a marriage, apart from inheritances and gifts made to one or the other of the spouses.

Equitable Property

A legal concept referring to rights and interests in property, often used to address fairness and justice in the distribution of assets.

Alimony

A financial support that one spouse is required to provide to the other during or after a divorce proceeding.

Q15: The variance on a portfolio that is

Q17: An individual's desire for intense risk-taking experiences

Q30: The expected return for the fad follower's

Q31: Assume that in the event of default,20%

Q33: The Volatility on Stock Y's returns is

Q35: If its managers engage in empire building,then

Q78: The volatility of your investment is closest

Q91: Suppose an investment is equally likely to

Q98: Which of the following statements is FALSE?<br>A)When

Q111: Which of the following statements is FALSE?<br>A)The