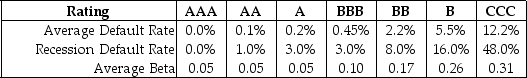

Use the following information to answer the question(s) below.Consider the following information regarding corporate bonds:

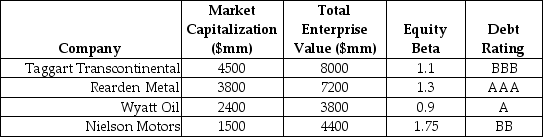

-Your estimate of the asset beta for Wyatt Oil is closest to:

Definitions:

Abstract Operations

A stage in Piaget's theory of cognitive development where individuals can think abstractly and reason logically.

Formal Operational Thought

A stage of cognitive development, as defined by Piaget, in which individuals can think abstractly and logically.

Concrete Operational Thought

A stage in Piaget's theory of cognitive development, typically occurring between ages 7 and 12, where children gain the ability to think logically about concrete events.

Egocentric Reasoning

Thinking characterized by a limited ability to see beyond one's own perspectives and consider the viewpoints of others.

Q2: If you take the job with Wyatt

Q12: The effective dividend tax rate for a

Q26: What is the expected return for an

Q57: Which of the following statements is FALSE?<br>A)The

Q67: The market value for Bernard is closest

Q80: Assume that you have $100,000 to invest

Q98: What is the excess return for Treasury

Q130: The _ approach is also referred to

Q187: A detailed vendor comparison would normally include

Q190: Defining requirements such as the amount of