Use the following information to answer the question(s) below.

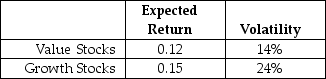

Suppose that all stocks can be grouped into two mutually exclusive portfolios (with each stock appearing in only one portfolio) : growth stocks and value stocks.Assume that these two portfolios are equal in size (market value) ,the correlation of their returns is equal to 0.6,and the portfolios have the following characteristics:  The risk free rate is 3.5%.

The risk free rate is 3.5%.

-Which of the following statements is FALSE?

Definitions:

Microsystems

Small, immediate environments where individuals interact and develop, such as families or classrooms.

Exosystem

A concept in ecological systems theory referring to the social settings that indirectly affect an individual, such as a parent's workplace or community policy decisions.

Prenatal Early Infancy

This term refers to the period before birth and the first few weeks of life, focusing on development and health aspects.

Substance Abuse

The harmful or hazardous use of psychoactive substances, including alcohol and illicit drugs, leading to addiction or dependence.

Q14: Which of the following organization forms accounts

Q20: In contrast to the managerial reporting process,

Q28: Which of the following statements regarding the

Q29: You overhear your manager saying that she

Q29: Which of the following is NOT an

Q32: Which of the following statements is FALSE?<br>A)If

Q42: The general ledger process comprises all of

Q54: The type of maintenance that is conducted

Q65: After the repurchase how many shares will

Q66: Which of the following has responsibilities and