Use the following information to answer the question(s) below.

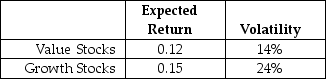

Suppose that all stocks can be grouped into two mutually exclusive portfolios (with each stock appearing in only one portfolio) : growth stocks and value stocks.Assume that these two portfolios are equal in size (market value) ,the correlation of their returns is equal to 0.6,and the portfolios have the following characteristics:  The risk free rate is 3.5%.

The risk free rate is 3.5%.

-The Sharpe ratio for the market (which is a 50-50 combination of the value and growth portfolios) portfolio is closest to:

Definitions:

Fraternal Twins

Twins that develop from two different eggs fertilized by two different sperm, resulting in siblings that are genetically distinct.

Extraembryonic Membrane

Membranes forming outside the embryo that support its development, including the yolk sac, amnion, chorion, and allantois in vertebrates.

Keeps Embryo Moist

A function of the amniotic egg or other structures in various organisms to prevent desiccation of the embryo in a terrestrial environment.

Extraembryonic Membrane

Membranes that are not part of the embryo but are essential for the development of the embryo, including the amnion, chorion, yolk sac, and allantois.

Q16: Assume that MM's perfect capital market conditions

Q30: LCMS' annual interest tax shield is closest

Q34: Do expected returns for individual stocks increase

Q55: Which of the following equations would NOT

Q72: Considering the fact that Luther's Cash is

Q78: The volatility of your investment is closest

Q79: The market capitalization for Wal-Mart is closest

Q99: Suppose that you want to use the

Q101: Determination of user requirements in the analysis

Q110: You want to maximize your expected return