Use the table for the question(s)below.

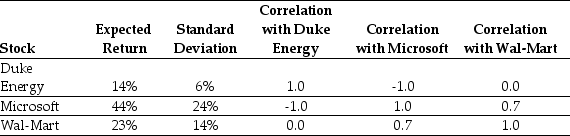

Consider the following expected returns,volatilities,and correlations:

-Consider a portfolio consisting of only Microsoft and Wal-Mart stock.Calculate the expected return on such a portfolio when the weight on Microsoft stock is 0%,25%,50%,75%,and 100%

Definitions:

Cotton

A natural fiber and cash crop that is used to produce textiles, clothing, and other products.

Relevant Geographic Market

The area in which a company operates and competes for customers, defined by where its customers are located and where it faces competitive pressures.

Anticompetitive

Actions or practices that unfairly limit competition in a market, often regulated by antitrust laws.

Merger

A merger is the combination of two or more companies into a single entity, often to achieve greater efficiencies and market share.

Q8: According to MM Proposition 1,the stock price

Q12: Wyatt's annual interest tax shield is closest

Q25: Luther's after-tax debt cost of capital is

Q53: Which of the following statements is FALSE?<br>A)When

Q69: Suppose that to raise the funds for

Q78: The volatility of your investment is closest

Q85: A indirect cost is one that can

Q127: Which of the following statements is FALSE?<br>A)Without

Q128: The Sharpe ratio for the market (which

Q139: The following is a jumbled list of