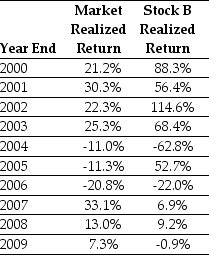

Use the table for the question(s)below.

Consider the following realized annual returns:

-Suppose that you want to use the 10 year historical average return on the Market to forecast the expected future return on the Market.Calculate the 95% confidence interval for your estimate of the expect return.

Definitions:

Open-Economy Macroeconomic Model

A framework for analyzing economies that engage in international trade, considering the impact of exchanges between domestic and foreign markets.

Trade Policies

Trade policies comprise laws and regulations governing international trade, including tariffs, trade agreements, and import/export controls, to protect domestic industries and manage economic relationships.

Trade Balance

The value of a nation’s exports minus the value of its imports; also called net exports.

Capital Flight

The large-scale exodus of financial assets and capital from a country due to economic instability or unfavorable policies, leading to a decrease in investment and economic growth.

Q10: In 2005,assuming an average dividend payout ratio

Q19: Your firm is planning to invest in

Q22: Suppose that to raise the funds for

Q26: The capacity requirements planning (CRP) process that

Q38: Assuming that Tom wants to maintain the

Q74: Which of the following statements is FALSE?<br>A)Holding

Q77: The expected return for Rearden Metal is

Q84: Consider the following equation:<br>E + D =

Q98: What is the excess return for Treasury

Q155: Which of the following is the assignment