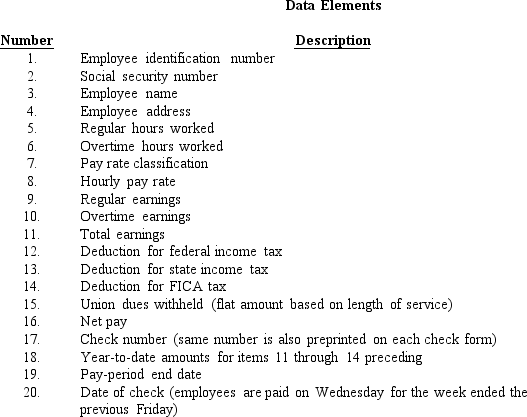

Assume you are working with a payroll application that produces weekly paychecks,including paystubs.Listed below are 20 data elements that appear on the paycheck/paystub.

Required:

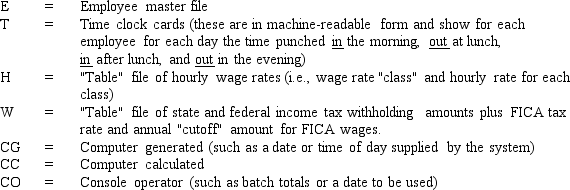

For each numbered item,indicate the immediate (versus ultimate)source of the item.For instance,the immediate source of the number of exemptions for an employee would be the employee master file as opposed to the ultimate source which is the W-4 form filed by the employee.Some items may have more than one source,as in the case of item 1.You have the following choices:

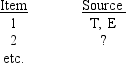

Arrange your answer as follows:

Definitions:

Increased By

A phrase indicating that a quantity has been added to, usually in the context of arithmetic operations or describing growth in a financial metric.

Increased By

An expression denoting an addition or increment in value or quantity.

HST

Harmonized Sales Tax; a combined tax in some Canadian provinces that merges the federal goods and services tax (GST) and provincial sales tax (PST).

Retail Price

The cost at which products are sold to the public, typically set higher than the wholesale price to include profit and expenses.

Q14: The vendor sends a(n)_ to notify the

Q17: The ultimate goal of the OE/S process

Q17: Continuous assurance (continuous auditing)will lead to:<br>A) fewer

Q25: The process of preparing paychecks for hourly

Q26: Production is initiated as individual sales orders

Q43: _ is the process of managing how

Q85: Sarbanes-Oxley,Section 409 states that companies ''shall disclose

Q129: Bar code readers are used to recognize

Q174: A computer system's _ is the quantity

Q204: Which of the following is not a