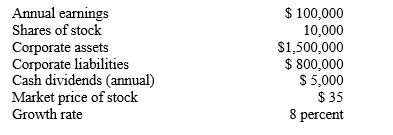

Toni and Felix are considering buying stock. They would like to purchase 600 shares of Sudsy Soap stock at $35 a share. Sudsy Soap had the following figures for the past year:

-What is Sudsy Soap's dividend per share?

Definitions:

Financing Costs

Expenses incurred by an entity in borrowing funds, including interest, fees, and other charges associated with the issuance of debt.

Incremental Cash Flow

The additional cash flow generated by a company from a new project or investment, after accounting for expenses.

Capital Budgeting Analysis

Capital budgeting analysis is the process of evaluating and selecting long-term investments that are in alignment with the goal of a company's shareholders' wealth maximization.

Opportunity Cost

The cost of choosing one option over another, representing the benefits an individual, investor, or business misses out on when choosing one alternative over another.

Q58: You can make changes in your group

Q76: A call option is an option contract

Q84: The largest potential financial loss resulting from

Q111: Lending investments are also called equities.

Q128: The SEC regulations regarding disclosure of fees

Q137: The mutual fund company owns the investments

Q178: Cash-value buildup is relatively slow in _

Q287: The current yield equals the bond's fixed

Q296: The money left over after a company

Q327: Refer to Figure 14-2.What is Sudsy Soap's