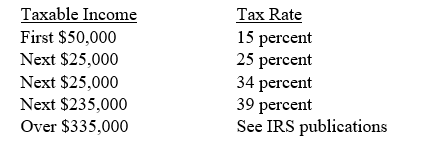

For the current year, Tyler Corporation reported net income before income taxes of $42,000. Using the following corporate income tax rates, compute the corporation's federal income taxes payable. (Assume that the firm's taxable income is the same as its income for financial accounting purposes.)

Definitions:

Diversity Competency

The ability to understand, respect, and manage differences among individuals, enhancing interpersonal interactions and organizational performance.

Protection

The act of keeping someone or something safe from harm, damage, or unwanted interference.

Anarchy

A state of society without government or law, often seen as chaos or a power vacuum.

Violence Continuum

This concept illustrates how acts of aggression can range from minor instances of verbal abuse to major physical assaults, indicating a spectrum of violence severity.

Q5: Explain the following terms-markon, markup, and markdown.

Q26: The fair market value of a share

Q28: Ryan Fuller, a sole proprietor, entered into

Q39: Walters and Kim are partners. The partnership

Q42: An increase in accounts payable is:<br>A)added to

Q45: Patsy Garrison owns and operates a bakery

Q73: A firm purchases an asset for $60,000

Q82: The telephone expense is allocated to the

Q89: Stocks may have a(n)--------- , or stated

Q111: The statement of cash flows is often