Figure 4.2

Figure 4.2

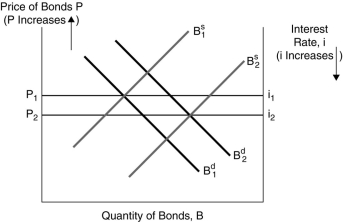

-In Figure 4.2, one possible explanation for a decrease in the interest rate from i2 to i1 is

Definitions:

De Jure Corporation

Latin for “lawful corporation” a corporation that has met the mandatory statutory provisions and thus received its certificate of incorporation.

De Facto Corporation

A company that acts like a corporation and enjoys some of its benefits, despite not being duly incorporated according to statutory requirements.

Corporation By Estoppel

A defective corporation that has conducted business with a third party and therefore cannot deny its status as a corporation to escape liability.

Double Taxation

The imposition of two or more taxes on the same income, asset, or financial transaction, often referring to income taxed both at the corporate level and personally.

Q2: On average, finance companies have a capital-to-total-asset

Q6: Describe the process of factoring? When and

Q10: Credit rationing occurs when lenders charge higher

Q15: Politicians in a democratic society may be

Q36: That taxpayers were poorly served by thrift

Q58: As a result of the subprime collapse,

Q60: A bank manager concerned about interest income

Q77: Because of the adverse selection problem, lenders

Q81: A moderately upward-sloping yield curve indicates that

Q110: Debt contracts<br>A)are agreements by the borrowers to