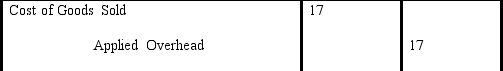

The journal entry for $17 of underapplied overhead is:

Definitions:

IRR Methods

Internal Rate of Return methods are used in capital budgeting to estimate the profitability of potential investments.

Negative NPV

A condition where the net present value (NPV) of an investment is less than zero, implying that the investment’s costs outweigh its benefits.

Cost of Capital

The minimum return needed to justify investing in a capital budgeting endeavor, such as the construction of a new facility.

Cost of Capital

Signifies the expected rate of return that market participants demand in order to commit money to an investment, considering risk and potential gains.

Q6: Units transferred from a prior process to

Q14: Dirth Company sells only one product at

Q42: Refer to Figure 7-8. Sallisaw uses an

Q60: The profit-volume graph shows the relationship between

Q63: Large manufacturing plants, such as chemical, food,

Q75: Biggers Company expects the following results for

Q87: _ can help a company become more

Q156: Using normal costing, which costs never enter

Q167: _ is critically important in determining cost

Q229: cost of inspections<br>A)variable<br>B)fixed