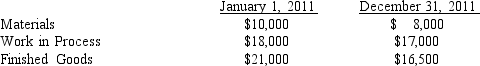

Figure 2-2.Lonborg Co. had the following beginning and ending inventory balances for the year ended December 31, 2011:

In addition, direct labor costs of $30,000 were incurred, overhead equaled $42,000, materials purchased were $27,000 and selling and administrative costs were $22,000. Lonborg Co. sold 25,000 units of product during the year at a sales price of $5.00 per unit.

In addition, direct labor costs of $30,000 were incurred, overhead equaled $42,000, materials purchased were $27,000 and selling and administrative costs were $22,000. Lonborg Co. sold 25,000 units of product during the year at a sales price of $5.00 per unit.

-Refer to Figure 2-2. What was Lonborg's operating income <loss> for the year?

Definitions:

Fixed Assets

Long-term tangible assets that a company uses in its operations and that are not intended to be sold in the regular course of business.

Interest Expense

Interest expense is the cost incurred by an entity for borrowed funds, typically noted on the income statement as a non-operating expense.

Depreciation

A method used in accounting to divide the expenditure of a tangible asset over the time it is useful.

Taxes Paid

The total amount of taxes remitted to the government by an individual or organization, including income, sales, and property taxes.

Q4: Investigating production variances and adjusting the production

Q19: Three measures of liquidity include working capital,

Q170: A company paid off a $100,000 2-year

Q173: A company reported the following information: <img

Q177: its value depends on the value of

Q182: (direct labor + overhead)/units produced<br>A)per-unit prime cost<br>B)per-unit

Q184: Which of the following is not an

Q189: remains constant on a per-unit basis within

Q199: Refer to Rags to Riches. Which of

Q212: Factory security costs<br>A)Product cost<br>B)Period cost