Use the table for the question(s) below.

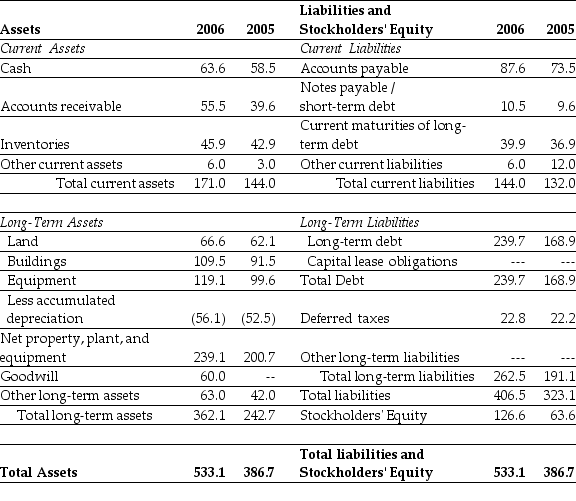

Consider the following balance sheet:

-If in 2006 Luther has 10.2 million shares outstanding and these shares are trading at $16 per share,then using the market value of equity,the debt to equity ratio for Luther in 2006 is closest to:

Definitions:

Activation Models

Theoretical frameworks that describe how aspects of cognition, such as attention and memory, are initiated and utilized in the processing of information.

Complexity

Complexity refers to the state or quality of being intricate or complicated, often used to describe systems, problems, or processes that involve multiple interconnected components.

Propositions

Logical statements that can be either true or false.

Postexperience Advertising Effect

The influence that advertisements have on a consumer's memory, perception, and evaluation of a product or experience after they have encountered it.

Q1: This model fits 96% of the data

Q2: In a corporation,the ultimate decisions regarding business

Q7: When using the book value of equity,the

Q20: The following ANOVA table shows the results

Q27: Consider the following sample of three measurements

Q62: If in 2006 Luther has 10.2 million

Q63: The difference between a nominal and a

Q67: Without issuing the new security,the NPV for

Q77: Luther's price - earnings ratio (P/E)for the

Q94: How many unpopped kernels are left when