Use the table for the question(s) below.

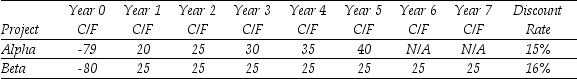

Consider the following two projects with cash flows in $:

-The NPV for project Alpha is closest to:

Definitions:

Test Category

A classification or grouping of tests based on certain criteria, like their purpose or the skills they assess.

COPSystem

The COPSystem is a comprehensive career guidance tool that helps individuals understand their interests, abilities, and values to make informed career decisions.

Test Category

A classification or grouping of tests based on their purpose, content, format, or intended population, such as academic assessments, personality tests, or skill evaluations.

Iowa Test

A standardized test used primarily in the United States to assess the educational development of students.

Q1: The paired data below consist of the

Q12: Which of the following statements is most

Q13: A researcher was interested in comparing the

Q34: The amount that the price of bond

Q38: Which of the following statements is false?<br>A)

Q48: You are considering an investment in an

Q51: You have an investment opportunity that will

Q52: The geometric average annual return on the

Q62: Which of the following investments offered the

Q92: Which of the following statements is false?<br>A)