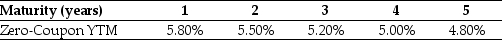

Use the table for the question(s) below.

Consider the following zero-coupon yields on default-free securities:

-The YTM of a 3-year default-free security with a face value of $1000 and an annual coupon rate of 6% is closest to:

Definitions:

District Court

A type of trial court where cases are initially argued and decided, typically involving federal or state laws.

Unanimously Agree

When all members of a group or assembly consent to a proposition or decision without any opposition.

Federal Judges

Judges appointed to the federal judiciary system in the United States, responsible for interpreting and applying federal laws and the Constitution.

Appointed for Life

A term typically used to describe the tenure of U.S. Supreme Court justices and certain other federal judges, who serve for life, pending good behavior.

Q5: The future value at retirement (age 65)of

Q9: You are looking for a new truck

Q34: The amount that the price of bond

Q50: Assuming that your capital is constrained,what is

Q50: Suppose that you want to use the

Q63: Which of the following is NOT a

Q67: The forward rate for year 3 (the

Q78: Which of the following statements is false?<br>A)

Q85: Which of the following statements is correct?<br>A)

Q95: Assuming that Luther's bonds receive a AAA