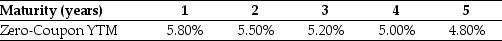

Use the table for the question(s) below.

Consider the following zero-coupon yields on default-free securities:

-The forward rate for year 3 (the forward rate quoted today for an investment that begins in two years and matures in three years) is closest to:

Definitions:

Periodic Interest

Interest that is calculated and applied at regular intervals over the life of a loan or investment, affecting the overall amount paid or received.

Bond Financing

A method of raising capital through the issuance of debt securities known as bonds, which are to be repaid at a specified maturity date along with periodic interest payments.

Carrying Value

The book value of assets and liabilities as recorded in the financial statements, excluding any depreciation or amortization.

Par Value

The face value of a bond or stock as stated on the certificate or instrument, not necessarily reflecting its market value.

Q15: If the current inflation rate is 5%,then

Q25: A 3-year default-free security with a face

Q25: Suppose that you want to use the

Q26: Which of the following statements is false?<br>A)

Q57: Another oil refiner is offering to trade

Q60: Which of the following formulas is incorrect?<br>A)

Q71: Which of the following statements is false?<br>A)

Q77: Cutting the firm's dividend to increase investment

Q78: To calculate the Capital Cost Allowance (CCA),Canadian

Q98: What is the expected return for an