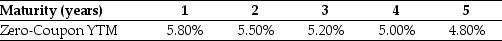

Use the table for the question(s) below.

Consider the following zero-coupon yields on default-free securities:

-The forward rate for year 2 (the forward rate quoted today for an investment that begins in one year and matures in two years) is closest to:

Definitions:

Preferential Payment

A payment made by a debtor to a creditor before a bankruptcy filing that gives the creditor more than it would receive in the debtor's bankruptcy.

Business Partner

An individual or entity that enters into a business relationship with another to pursue mutual goals and interests, often sharing profits, losses, and control.

Bankruptcy Proceedings

A legal process through which individuals or businesses unable to repay their debts may seek relief and undergo a structured repayment or asset liquidation process.

Insolvent

The state of being unable to pay debts owed, often leading to legal proceedings for liquidation or restructuring.

Q1: Which of the following statements is false?<br>A)

Q5: The YTM of a 4-year default-free security

Q54: Consider a portfolio consisting of only Duke

Q58: You are considering purchasing a new truck

Q62: It is _ that determines the cost

Q65: A decrease in the sales of a

Q67: In Canada,one of the reasons that the

Q74: Calculate the variance on a portfolio that

Q75: If KT expects to maintain a debt-to-equity

Q79: The _ cost of debt to the