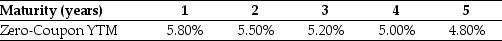

Use the table for the question(s) below.

Consider the following zero-coupon yields on default-free securities:

-The forward rate for year 5 (the forward rate quoted today for an investment that begins in four years and matures in five years) is closest to:

Definitions:

Equilibrium

A situation in a market where the quantity demanded equals the quantity supplied, leading to no net change in price.

Quantity Supplied

The total amount of a good or service that producers are willing to sell at a given price level.

Compact Disks

Optical storage media used to store data, including music and software, now largely superseded by digital formats.

Substitute

A product or service that can be used in place of another to satisfy consumer demand.

Q3: Which of the following statements is correct?<br>A)

Q7: Which of the following statements is false?<br>A)

Q10: The yield curves of bonds issued by

Q12: When Canadian firms need to determine the

Q15: Which of the following statements is false?<br>A)

Q30: Consider a zero-coupon bond with a $1000

Q33: Which of the following statements is false?<br>A)

Q35: Suppose you plan to hold Von Bora

Q46: The total market capitalization for all four

Q68: Which of the following statements is false?<br>A)