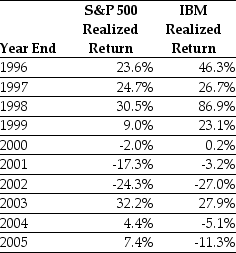

Use the table for the question(s) below.

Consider the following realized annual returns:

-The geometric average annual return on the S&P 500 from 1996 to 2005 is closest to:

Definitions:

Annual Average Investment

The mean amount of funds invested over a certain period, typically used to calculate the return on investment over that period.

Q1: Show mathematically that the stock price of

Q2: Assume that the S&P 500 currently has

Q8: One of the reasons that it is

Q12: The volatility of a portfolio that consists

Q23: Using the data provided in the table,calculate

Q29: What are some implicit assumptions that are

Q36: You are considering purchasing a new automated

Q81: Which of the following statements is false?<br>A)

Q95: The yield to maturity of a bond

Q103: Consider a portfolio consisting of only Microsoft