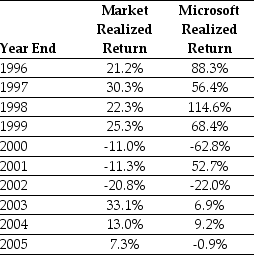

Use the table for the question(s) below.

Consider the following realized annual returns:

-Using the data provided in the table,calculate the average annual return,the variance of the annual returns,and the standard deviation of the average returns for the market from 1996 to 2005.

Definitions:

Expired Insurance

Insurance coverage that has come to an end or is not in force due to the expiration of the policy term.

Total Assets

The sum of all current and non-current assets owned by a company, representing the total resources available to the company.

Owner's Equity

The residual interest in the assets of the entity after deducting liabilities, representing the ownership interest of shareholders or owners in a company.

Adjusting Journal Entry

A type of journal entry made at the end of an accounting period to allocate income and expenditure to the appropriate period.

Q9: The volatility of a portfolio that is

Q9: Which of the following statements is false?<br>A)

Q10: Which of the following statements is false?<br>A)

Q24: Plot the zero-coupon yield curve (for the

Q27: The NPV for project Alpha is closest

Q29: The internal rate of return (IRR)for project

Q50: Based upon the price earnings multiple,the value

Q53: Explain why the NPV decision rule might

Q70: You want to maximize your expected return

Q71: NoGrowth Industries presently pays an annual dividend