Use the table for the question(s) below.

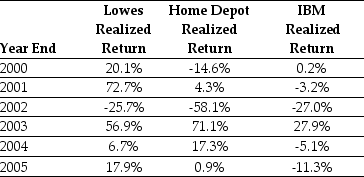

Consider the following returns:

-The volatility on IBM's returns is closest to:

Definitions:

Coinsurance Clause

A provision in certain insurance policies requiring the policyholder to bear a specified percentage of the costs of covered services.

Property Insurance

Insurance coverage that provides protection against most risks to property, such as fire, theft, and some types of weather damage.

Fair Market Value

The price that a property would sell for on the open market between a willing buyer and a willing seller, with neither being required to act, and both having reasonable knowledge of the relevant facts.

Indemnity Contracts

Agreements that provide protection or security against potential loss or damage, often requiring one party to compensate the other for any loss or damage incurred.

Q13: When corporations raise funds from outside investors,they

Q13: What is the price today of a

Q13: What are some common multiples used to

Q32: The NPV for project Beta is closest

Q36: Which of the following statements is false?<br>A)

Q38: Which of the following is NOT an

Q43: Consider a corporate bond with a $1000

Q46: The free cash flow for the first

Q81: Assuming that in the event of default,20%

Q101: A portfolio weight is _ of individual