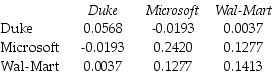

Use the table for the question(s) below.

Consider the following covariances between securities:

-The variance on a portfolio that is made up of a $6,000 investment in Duke Energy stock and a $4,000 investment in Wal-Mart stock is closest to:

Definitions:

Sexual Partners

Individuals with whom one engages in sexual activity, within various contexts ranging from casual to long-term relationships.

Evolutionary Psychologists

Scientists who study the psychological adaptations of humans to the changing physical and social environment, particularly from a prehistoric perspective.

Sociobiologists

Scientists who study the biological basis of all social behavior, including that of humans, often considering how evolution has shaped social behaviors.

Evolutionary Origins

The historical development of a species, trait, or behavior from its ancestors, explained through the process of natural selection and genetic variation.

Q8: One of the reasons that it is

Q22: What is the variance on a portfolio

Q23: Using the data provided in the table,calculate

Q31: Increasing the amount invested in i will

Q32: Which of the following statements is false?<br>A)

Q55: Which of the following statements is false?<br>A)

Q59: Which of the following statements is false?<br>A)

Q89: Assume that Kinston's new machine will be

Q90: Luther Industries has outstanding tax loss carryforwards

Q91: Which of the following statements is false?<br>A)