Multiple Choice

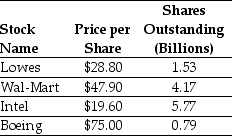

Use the table for the question(s) below.

Consider the following stock price and shares outstanding data:

-Which of the following is NOT an assumption used in deriving the Capital Asset Pricing Model (CAPM) ?

Definitions:

Related Questions

Q2: Ignoring the original investment of $5 million,what

Q12: Assume that you own 2500 shares of

Q16: Assume that in addition to 1.25 billion

Q37: Which of the following statements is false?<br>A)

Q44: In Canada,the deductions of Capital Cost Allowance

Q47: Book-to-market ratio is the ratio of _.<br>A)

Q52: Consider the following equation: P<sub>retain</sub> = P<sub>cum</sub>

Q78: Consider a zero-coupon bond with a $1000

Q78: The efficient portfolio offers _ Sharpe ratio

Q83: What is an opportunity cost? Should it